Oscar Health Inc.

TICKER TALK

Dear Subscribers,

Welcome to the first edition of our stock spotlight newsletter, where we dive into one compelling company each time. We'll break down the fundamentals, technical picture, potential upsides, and risks to help you form your own informed view. Remember, this is for educational purposes only—always consult a financial advisor before making investment decisions.

LET’S DIVE IN →

Feature company

Oscar Health Inc. NYSE: OSCR

Today, we're focusing on Oscar Health, Inc. (NYSE: OSCR), a technology-enabled health insurance provider that's shaking up the traditional industry with its user-friendly platform and data-driven approach

The Fundamentals

Company Fundamentals: Strong Growth Momentum

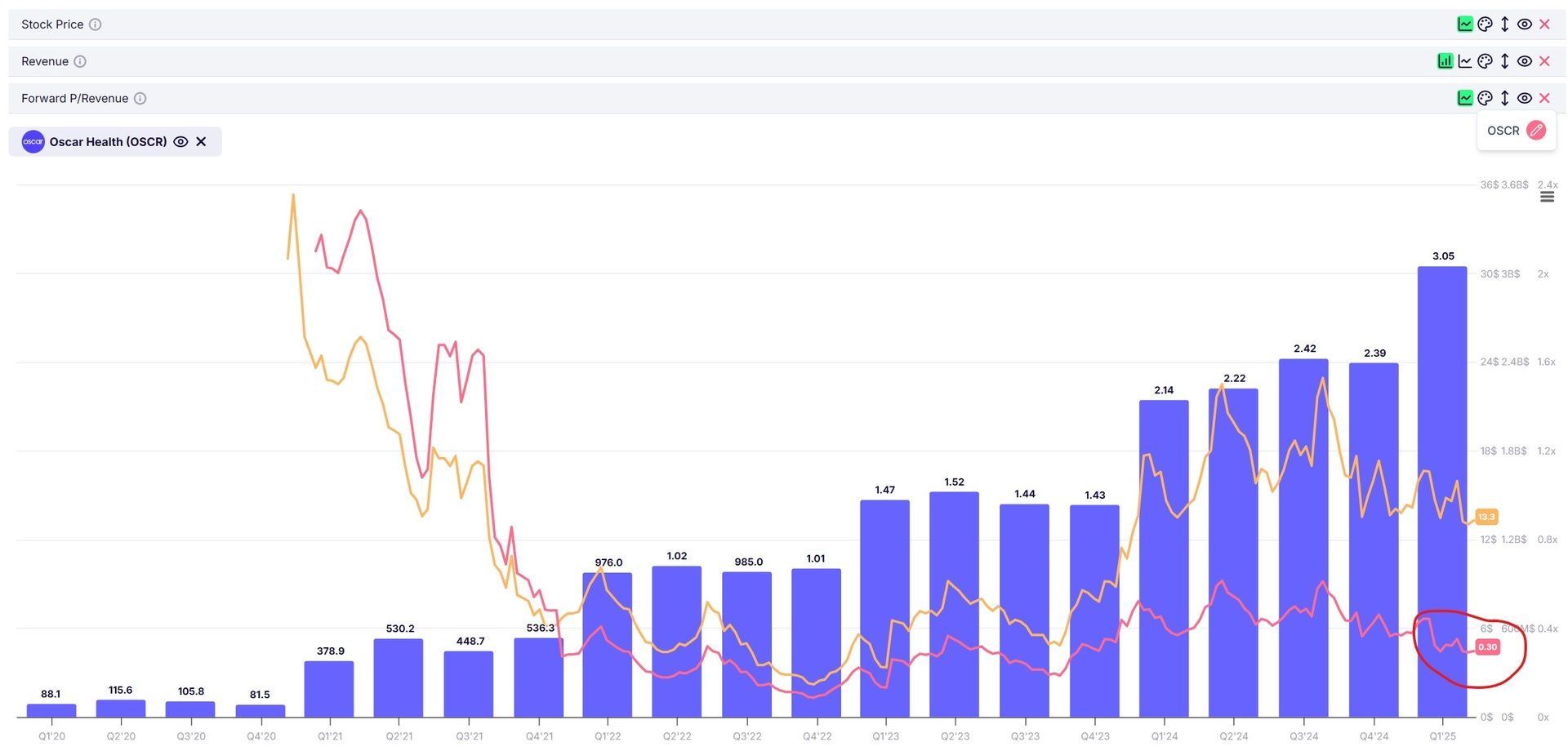

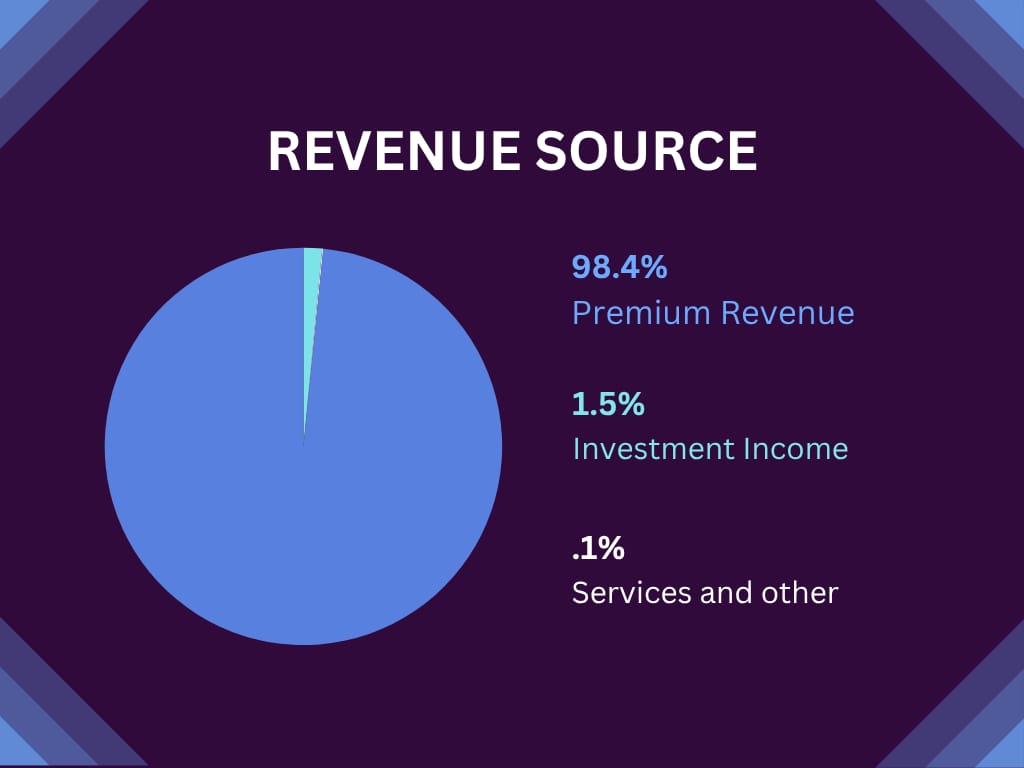

Oscar Health has shown impressive financial progress, transitioning from losses to profitability amid rapid expansion. Here's a snapshot of key metrics as of mid-July 2025 (based on trailing twelve months and latest quarterly data):

Market Capitalization: Approximately $3.9 billion, reflecting a mid-cap player in the competitive health insurance space.

Revenue: $10.08 billion, with Q1 2025 alone hitting $3.05 billion—a 42% year-over-year increase driven by member growth and operational efficiencies.

Net Income: $123.33 million, marking a shift to positive territory after years of red ink.

Earnings Per Share (EPS): $0.40, with Q1 2025 delivering a standout $0.92—far exceeding expectations.

Valuation Metrics: Trailing P/E ratio of about 38, forward P/E around 21, and a price-to-sales ratio of 0.4, suggesting the stock isn't overly expensive relative to growth.

Balance Sheet: Cash position of $2.99 billion provides a solid buffer, while total debt stands at $359 million (debt-to-equity ratio of 27%). Operating cash flow reached $1.22 billion, indicating healthy liquidity.

Profitability: Profit margin at 1.22%, with an operating margin of 9.75%. Return on equity is 10.48%, showing efficient use of shareholder capital.

Oscar's guidance for full-year 2025 projects revenue between $11.2 billion and $11.3 billion, with adjusted EBITDA of $140 million to $190 million. Analysts forecast sales climbing to $13 billion by 2027, fueled by AI integrations and market expansions into new states. Overall, fundamentals point to a company scaling effectively in a $4 trillion U.S. healthcare market.

(Data from Oscar Health’s Q1 2025 report)

Technical Analysis:

Volatile but Showing Signs of Recovery

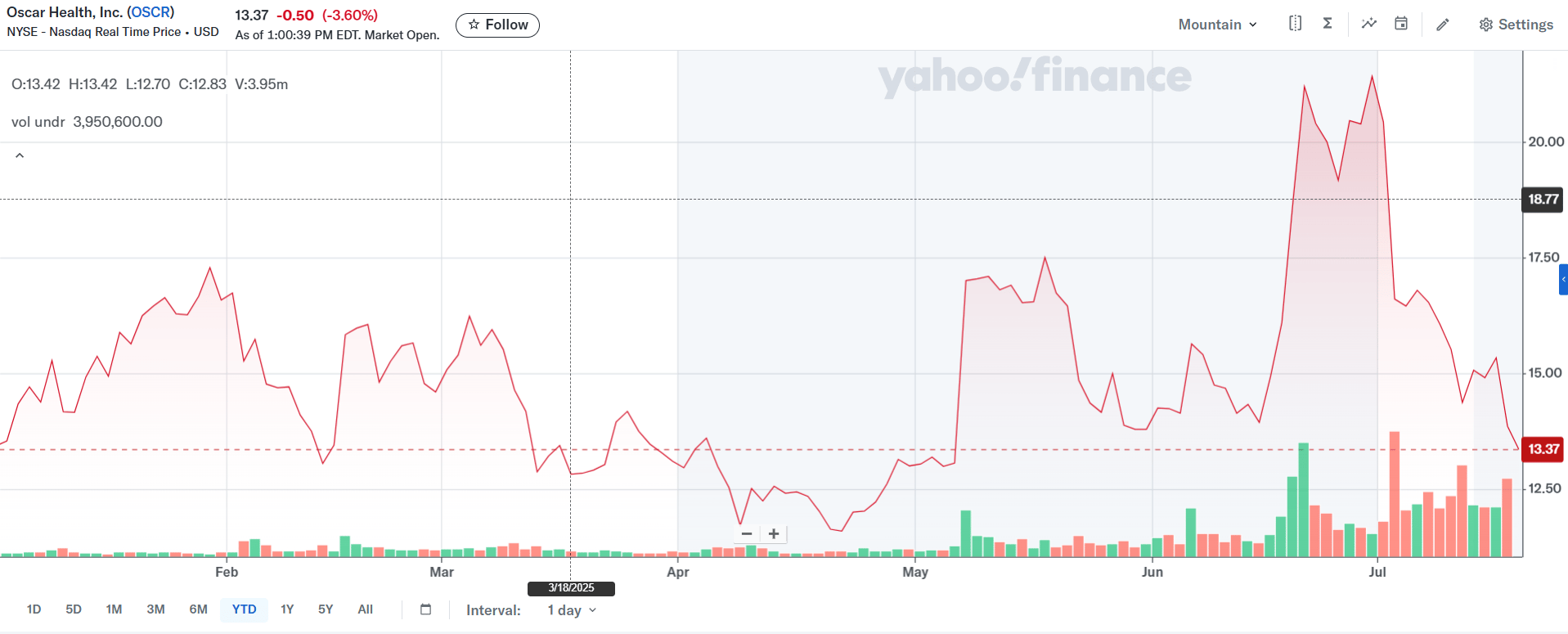

Year to Date price chart from finance.yahoo.com

OSCR's stock has been a rollercoaster, reflecting the healthcare sector's sensitivity to regulations and economic shifts. As of July 16, 2025, shares closed at $15.35, up 2.88% for the day and 14.21% year-to-date—outpacing the S&P 500's 6.50% gain. However, it's down 5.19% over the past year, trading within a 52-week range of $11.20 to $23.79.

Key technical indicators:

Moving Averages: The stock is in a medium-term falling trend channel, but recent breaks above short-term resistance (e.g., around $15.15) suggest potential bullish momentum if it holds above this level.

RSI (Relative Strength Index): At 42.90, indicating neutral territory—not overbought or oversold.

MACD (Moving Average Convergence Divergence): Positive at 0.24, hinting at building upward pressure.

Beta: 1.90, meaning it's more volatile than the market, amplified by sharp moves like a 52% jump in June 2025 amid positive earnings and sector optimism.

Support/Resistance: Support near $14.38 (recent lows), with resistance at $17–$18. A break above $17 could target the mid-$20s, while a drop below $15 might test $13.

Analyst sentiment is mixed: Consensus price target around $17.49 (upside from current levels), but ratings range from "Buy" to "Sell" due to sector uncertainties. Recent X chatter shows traders eyeing a push to $17, with some adding it to watchlists.

Risk/Reward profile

Potential Gains: Upside from Innovation and Expansion

If Oscar executes well, the rewards could be significant:

Growth Trajectory: With membership surging and AI tools improving claims processing, revenue could grow 23% in 2025, potentially driving EPS higher and stock appreciation to $18–$20 (analyst targets).

Market Opportunities: Expansion into new markets and tech integrations could capture more of the ACA segment, especially if healthcare reforms favor digital insurers. Bullish scenarios see upside to $48 by 2025 if profitability accelerates.

Sector Tailwinds: Rising demand for affordable plans amid economic pressures could boost enrollment, with long-term outperformance potential (e.g., 26% upside per some analysts).

Valuation Appeal: At current multiples, successful margin expansion (targeting 80.7%–81.7% medical loss ratio) could rerate the stock higher.

In a best-case scenario, OSCR could deliver 20–50% returns over the next 12–18 months if it capitalizes on its tech edge.

Potential Risks: Regulatory and Operational Hurdles

No investment is without pitfalls, and Oscar faces several:

Regulatory and Political Risks: Healthcare policy changes, especially around ACA subsidies or budget cuts in 2026, could slash enrollment (analysts predict up to 30% drop). Recent litigation and scrutiny add uncertainty.

Cost Pressures: Rising medical costs and a medical loss ratio creeping up (75.4% in Q1 2025) might squeeze margins if pricing doesn't keep pace. Wells Fargo's downgrade cited inadequate coverage for trends.

Liability Concerns: Potential underestimation of risk adjustment payables could lead to $880 million in extra liabilities, eroding profits.

Market Volatility: High beta means OSCR amplifies sector downturns; recent 5–10% drops on downgrades highlight this.

Competition: Larger insurers like UnitedHealth could erode market share, and mixed analyst ratings (including "Sell") reflect limited visibility.

These risks could pressure the stock toward $13 or lower if headwinds materialize.

A Final Note

Final Thoughts

Oscar Health stands out as an innovative disruptor in a stodgy industry, with solid fundamentals supporting growth. Technically, it's stabilizing with upside potential, but risks from regulations and costs warrant caution. Whether it's a buy depends on your risk tolerance—bulls see transformative potential, while bears worry about execution in a turbulent sector.

Look into OSCR and see if it fits your investment goals and risk profile, and stay tuned for our next spotlight.

Best regards,

Ticker Talk

Disclaimer: This newsletter is not financial advice. Stock investing involves risk, including possible loss of principal. Past performance doesn't guarantee future results. Do your own research and consult professionals. Data sourced from public financial sites and may change.

Data sourced from public financial reports and market analysis https://ir.hioscar.com/

Until next time,