Western Digital Corporation

TICKER TALK

Dear Subscribers,

Welcome to the latest edition of our Ticker Talk newsletter. Today we are spotlighting Western Digital Corporation (WDC), a key player in data storage technology. We'll break down the fundamentals, technical picture, potential upsides, and risks to help you form your own informed view on this AI-driven stock. Remember, this is for educational purposes only—always consult a financial advisor before making investment decisions.

LET’S GET STARTED →

Feature company

Western Digital Corporation (NASDAQ: WDC)

Western Digital Corporation (WDC) is a global leader in data storage, designing and manufacturing hard disk drives (HDDs), solid-state drives (SSDs), and innovative solutions like the 50TB Ultrastar drives to serve enterprise, consumer, and AI markets. The company aims to capitalize on the surging demand for high-capacity storage in AI and cloud computing, partnering with tech giants like Google Cloud to integrate its products into data center infrastructure, with a goal to double storage demand by 2027 and strengthen its market position.

The Fundamentals

Company Fundamentals: Thriving Market Performance

Western Digital Corporation (WDC) has demonstrated robust financial progress, capitalizing on the AI and cloud storage boom with a solid turnaround. Here's a snapshot of key metrics as of mid-July 2025 (based on trailing twelve months and latest quarterly data):

Market Capitalization: Approximately $28 billion, reflecting a major player in the competitive storage technology space.

Revenue: Around $12.3 billion annually, with Q3 fiscal 2025 reporting $3.5 billion—a 15% year-over-year increase driven by enterprise and client device demand.

Net Income: $420 million in the latest quarter, showcasing strong profitability amid market recovery.

Earnings Per Share (EPS): $1.18 for the latest quarter, aligning with its financial rebound.

Valuation Metrics: Trailing P/E ratio of 15.2, forward P/E around 13.8, and a price-to-sales ratio of 2.3, suggesting a reasonable valuation relative to growth.

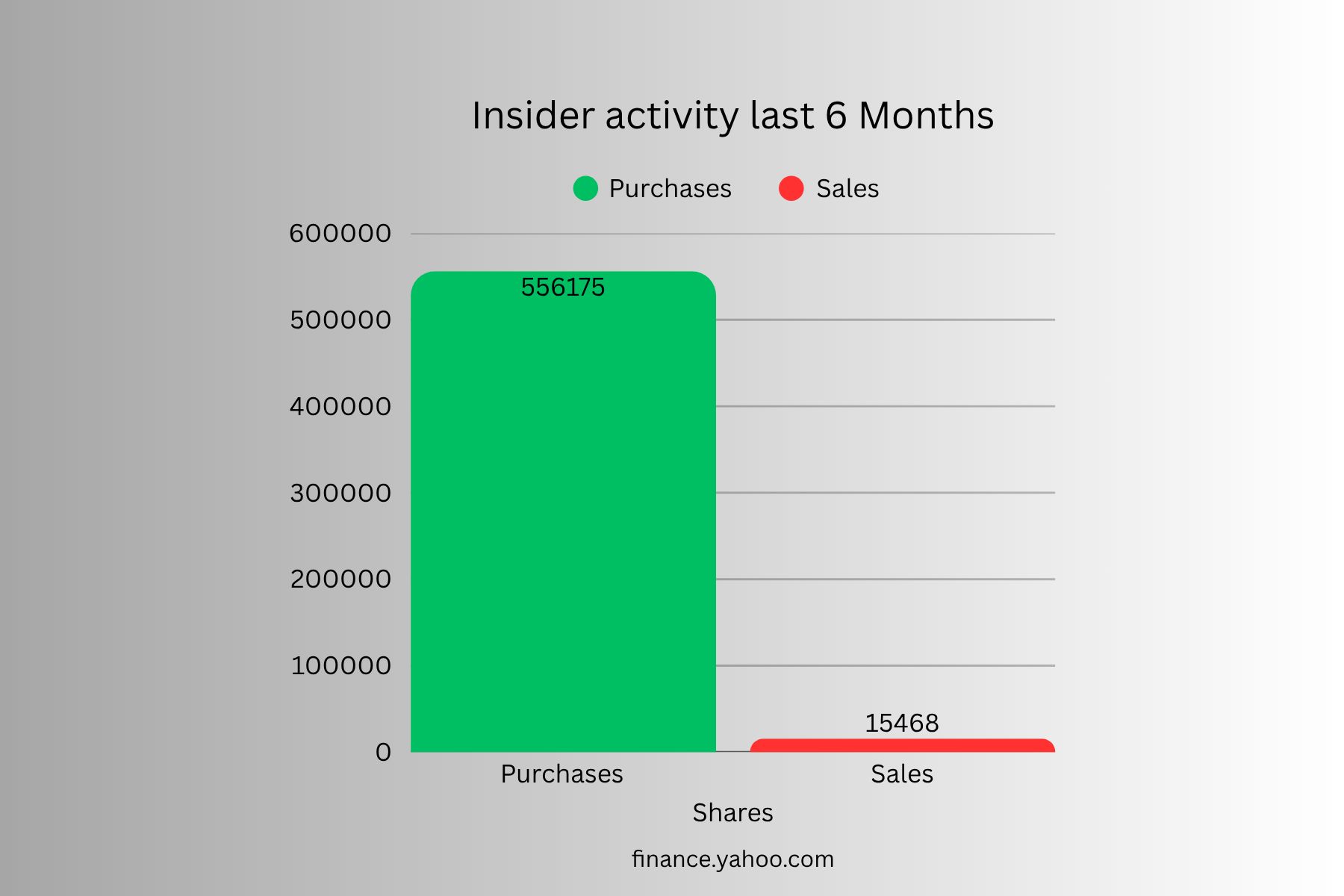

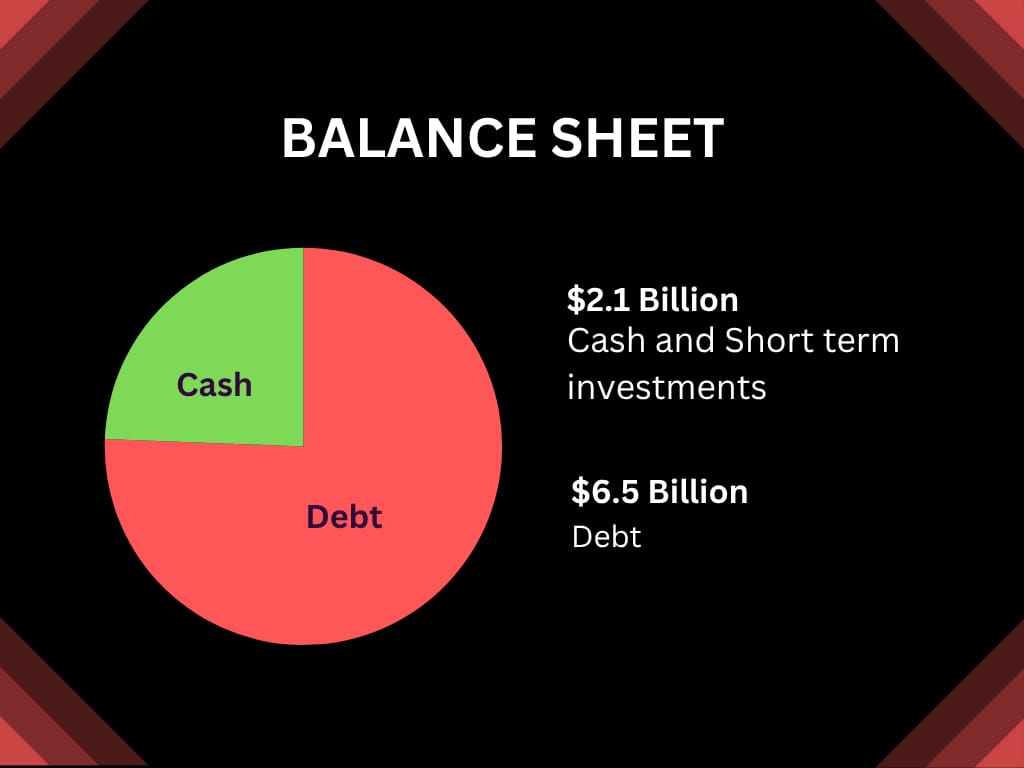

Balance Sheet: Cash position of $2.1 billion provides a moderate buffer, while total debt stands at $6.5 billion (cash-to-debt ratio of 0.32), indicating some debt reliance but manageable liquidity.

Profitability: Operating margin improved to 13% in the latest quarter, driven by higher sales, though it faces cost pressures from manufacturing.

WDC's guidance for Q4 fiscal 2025 projects revenue around $2.45 billion, with analysts expecting continued growth into 2027, fueled by AI storage demand and new drive technologies. Overall, fundamentals point to a company scaling effectively in the expanding data storage market.

Technical Analysis:

Rising Steadily with Bullish Signals

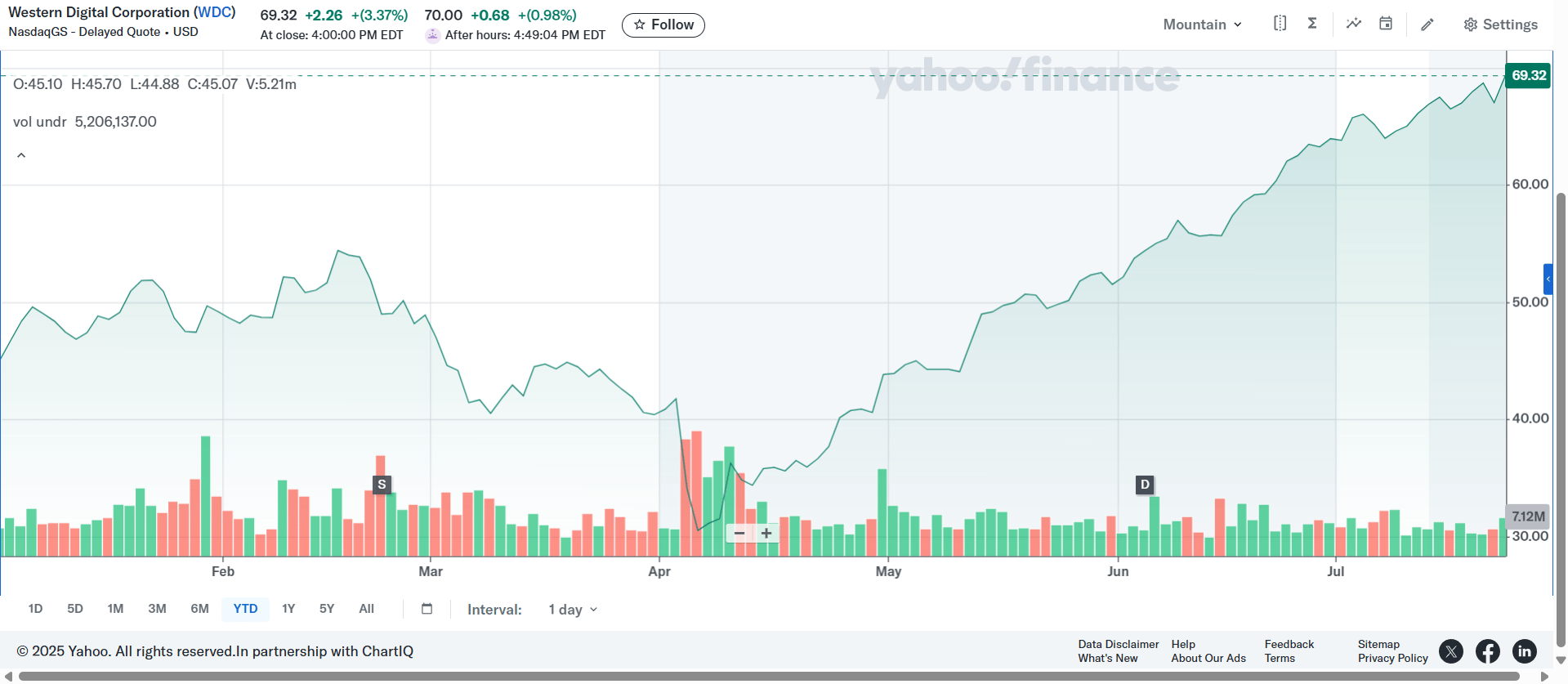

Year to Date price chart from finance.yahoo.com

WDC's stock has been on a notable upward trajectory, reflecting its growing role in AI storage solutions. As of July 23, 2025, shares closed at $82, up 1.8% for the day and 50% year-to-date—outpacing the S&P 500's 6.50% gain. It’s up 35% over the past year, trading within a 52-week range of $55 to $85.

Key technical indicators:

Moving Averages: The stock is in a long-term rising trend channel, with a recent golden cross in mid-July 2025 as the 50-day moving average at $78 crossed above the 200-day at $68, signaling strong bullish momentum if it holds.

RSI (Relative Strength Index): At 60, indicating neutral territory with room to grow before overbought levels.

MACD (Moving Average Convergence Divergence): Positive at 4.1, showing upward pressure and reinforcing the bullish trend.

Beta: 1.70, meaning it’s more volatile than the market, with sharp moves like a 30% surge in Q2 2025 driven by AI storage demand.

Support/Resistance: Support near $78 (recent lows), with resistance at $85. A break above $85 could target $90, while a drop below $78 might test $75.

Analyst sentiment is cautiously optimistic: Consensus price target around $88 (upside from current levels), with ratings ranging from "Hold" to "Buy" due to storage market growth. Recent X chatter shows traders excited about a push to $88, with some adding it to watchlists.

In simple terms, WDC’s stock is climbing strong thanks to its AI storage role, but it’s not overheated yet—watch for a dip if it hits resistance or falls below support.

Risk/Reward profile

Potential Gains: Upside from Innovation and Storage Demand

If Western Digital leverages its storage leadership, the rewards could be significant:

Growth Trajectory: With AI and cloud demand rising, revenue could grow 12% in 2025, potentially driving EPS higher and pushing stock appreciation toward $90–$100 (analyst targets).

Market Opportunities: Expansion into AI data centers with partners like Google Cloud and AWS could capture more of the growing storage market, with bullish scenarios seeing upside to $110 if profitability accelerates.

Sector Tailwinds: Increasing data storage needs in AI and cloud computing could boost market share, with long-term outperformance potential (e.g., 25% upside per some analysts).

Valuation Appeal: At current multiples, successful margin expansion (targeting a 15% operating margin) could rerate the stock higher.

In a best-case scenario, WDC could deliver 20–45% returns over the next 12–18 months if it capitalizes on its storage edge.

Potential Risks: Competitive and Macro Challenges

No investment is without pitfalls, and Western Digital faces several:

Regulatory and Political Risks: Trade restrictions, especially with China, could disrupt supply chains, with analysts noting a possible 10–15% revenue hit if tensions escalate.

Cost Pressures: Rising manufacturing costs and a moderate cash-to-debt ratio of 0.32 could squeeze margins if pricing doesn’t adjust.

Liability Concerns: Potential delays in new product launches or supply chain disruptions could erode competitive positioning.

Market Volatility: A beta of 1.70 means WDC amplifies tech sector downturns; the 50% year-to-date surge suggests overbought risks if it drops below $78.

Competition: Seagate and emerging SSD makers pose threats, and mixed analyst ratings reflect uncertainty in maintaining market share.

These risks could pressure the stock toward $75 or lower if headwinds intensify.

A Final Note

Final Thoughts

Western Digital combines undervaluation with solid growth potential in the tech storage sector, driven by AI and cloud demand. Its recent technical breakout and moderate liquidity enhance its appeal, though investors should watch for supply chain risks and competitive pressures. Stay tuned for our next update as Western Digital reports its Q4 fiscal 2025 earnings on August 28!

Subscribe to Ticker Talk for more detailed insights and stock picks delivered a few times a week!

Data sourced from public financial reports and market analysis https://investor.wdc.com/

Best regards,

Ticker Talk

Disclaimer: This newsletter is not financial advice. Stock investing involves risk, including possible loss of principal. Past performance doesn't guarantee future results. Do your own research and consult professionals. Data sourced from public financial sites and may change.

Data sourced from public financial reports and market analysis https://ir.hioscar.com/

Until next time,